Start-ups looking to enter a market for the first time, or established businesses seeking to launch a new product or service should never underestimate the power of running scenarios. It is always surprising to us how few organisations look at alternative futures when analysing potential market share. That's not just in terms of the total addressable market, but also the Serviceable Addressable Market and ultimately the Serviceable Obtainable Market to plan their business development strategy.

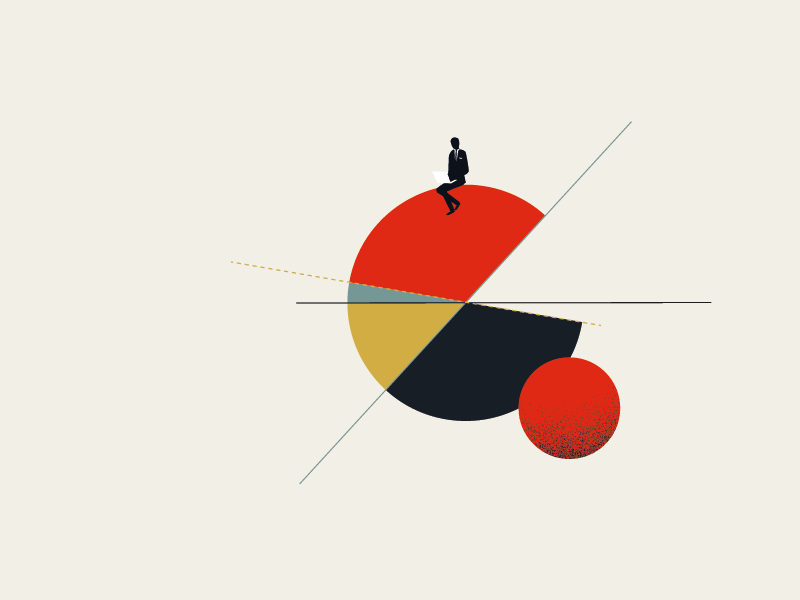

It's not enough to know what the total market is; what's relevant is understanding the market share that's realistically attainable for you and your business. We do this by breaking it down into the following:

- The Total Addressable Market (TAM), also referred to as the total available market, is the overall revenue opportunity available to a product or service if a business achieved 100% market share.

- Serviceable Addressable Market (SAM) refers to the specific potential audience for your product or professional service. This metric is the maximum market value your company could potentially have.

- Serviceable Obtainable Market (SOM) is also known as market share and is the percentage of the market that the company can realistically obtain.

Understanding your market share in real terms

Getting these numbers will allow you to play out different scenarios and help business leaders make meaningful business development plans and decisions, ultimately helping to future proof the company.

This type of market share analysis will help you to answer questions like:

- Are my potential customers people or firms who are new to the market?

- Are they individuals or firms who may switch from a competitor?

- How many people or firms are leaving the market altogether?

- Why are people or businesses coming to me?

The Corporate Finance Institute used the example of the consumer foods market. In 2014 the market value was estimated at 200 billion Euros. That market included food as well as alcoholic and non-alcoholic drinks. The alcoholic drinks industry's SAM was 49 billion Euros. The section of the alcoholic drinks industry that one manufacturer serves is the SOM for that individual company - a far cry from the total addressable market.

Another example, put forward by Fractional CMO Ulka Athalye, highlighted that companies expanding into India often think of it as this vast market because its population is large (1.3 billion). She noted that if you're talking about food and drink or an everyday essential, like toothpaste, then yes, the market is enormous. However, if you're selling a premium product (like handbags), then it's a much smaller market that you will be targeting.

A more informed business development strategy

Whether you're a B2B or B2C organisation, if you don't think about these figures, then the odds are you won't be aware of what you should be doing to reach the relevant people or companies. What our marketing experts often see happening with new businesses is at the outset, it may not show in their results whether they have this data or not. If they're a small fish in a big pond, then they will likely gain some traction. However, there will become a point - quicker than they might imagine - where growth becomes less possible unless they're fully aware of who is coming to them, why and who else is out there.

Not analysing the market can lead businesses to spend a lot of money developing a product or service without knowing whether the company can monetise the idea. Of course, there are cases where industries are breaking new ground, where it's challenging to calculate the SOM. The Internet of Things (IoT) has been a prime example of an area where investors have been making difficult predictions over time that are largely conjecture.

How to analyse your market share and grow your business

Analysing your market share is a combination of precise details alongside broad hypotheticals. In today's world of data, it's easier to be more accurate about figures and other elements contributing to business opportunities and forecasts. However, as we know from the global pandemic, there's only a certain amount that figures can predict.

This is where hypotheticals can be extremely helpful - creating scenarios for best and worst-case outcomes to ensure you're prepared. Different marketing experts will advise on different approaches. However, broadly speaking, it's a combination of tools, techniques and experience-led analysis.

Tools you can use include:

- Online research

- Financial reports

- Market research

- Interviews and in-person visits to other companies and people in the industry

Approaches you can take include:

- Talking to and surveying new customers and for those who have chosen to leave you - front-line staff will have great granular insights

- Compile existing secondary market research such as information from adjacent markets, market leaders and competitors.

- Analyse from the top-down by taking a metric (like population) and using types of market segmentation according to different factors such as price, age, demographic.

- Analyse from the bottom-up by determining specifics of production and then calculating that number across the market. (Start with one client, for example, and work up.)

- Verify your assumptions with the help of experts - although it's important to recognise that some information may be confidential.

- Calculate market sensitivities - remember that things are constantly changing, and new markets are susceptible to influential factors, such as price and the economy.

If you would like to speak to experienced marketing experts about analysing your market share and target audience, as well as improving total sales, contact the team at gigCMO.

Watch the Video